BaFin-compliant:

High data quality for audits

We make financial service providers fit for DORA, BAIT, KAIT, VAIT and MaRisk

Many requirements - one solution

Financial service providers such as banks, insurance companies and credit institutions are under constant pressure to comply with a multitude of rules and regulations. Not only the GDPR and the KRITIS regulations make handling data more difficult, but also the BaFin's catalogues of requirements: KAIT, BAIT and VAIT. These requirements demand the highest level of data management to ensure smooth operations and legal compliance.

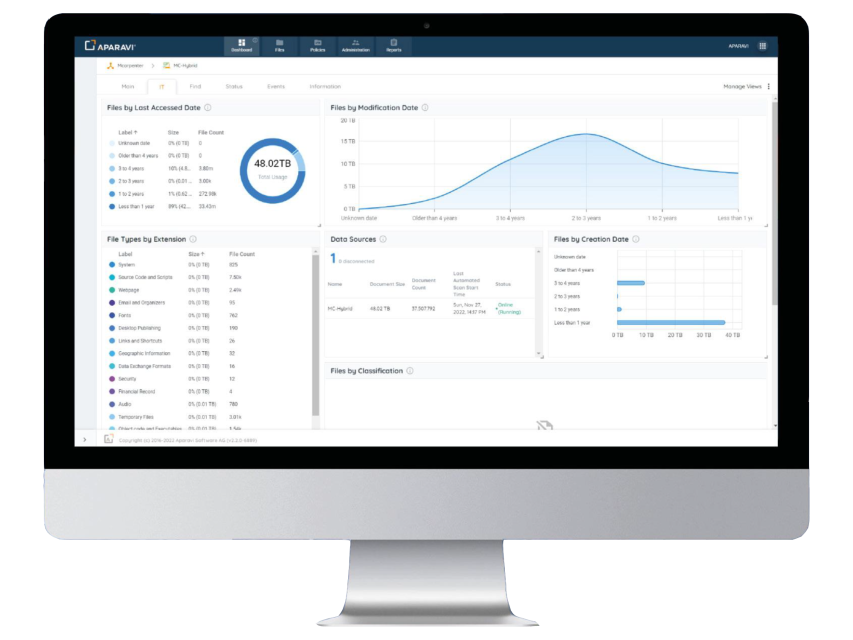

APARAVI offers a specialised solution tailored to the complex needs of financial service providers to make data management and compliance efficient and legally compliant.

BaFin requirements at a glance

The EU's Digital Operational Resilience Act (DORA) considers all components of operational resilience and explicitly includes rules for IT risk management.

The BAIT, VAIT and KAIT are BaFin guidelines that set clear requirements for the technical and organisational design of information technology (IT), IT systems and IT peripherals in German financial companies. Their main objective is to strengthen information security and IT governance in these companies and to raise awareness of IT-related risks.

In addition, MaRisk implements the qualitative requirements of Basel II and Basel III into German law.

Maximum transparency for individualised data processing applications

Prepare your data for §44 BaFin special audits

Individualised data processing in the financial sector is classified as very critical by the German Federal Financial Supervisory Authority (BaFin), as it often entails inadequate quality assurance, documentation and limited traceability. Insurers, banks and financial service providers often use Excel, among other things, to create workarounds for complex calculations. The risks in this example are often underestimated: process breaks, a lack of documentation, a high susceptibility to errors in calculations and a lack of transparency are not tolerated by BaFin.

APARAVI offers a powerful solution for searching masses of data from any source for individualised data processing. Your data is indexed and classified, the results are presented in comprehensible reports and transferred to transparent processes.

APARAVI - We make your data ready for BaFin

Find, index and categorise outdated documents in

- Sharepoint

- File systems

- OneDrive

- OnPrem or Cloud

- Transparent setup

- Customised classifications

- Scan processes

- Deletions without black box or human error

- Recognise anomalies and unusual access to critical files

- Optimum integrity assurance of log data in source systems

- Creation of registers

- Classification of applications depending on their risk

- Appropriate quality assurance

- Preventive measures for cyber attacks

- Dashboard with an overview of all critical data

- Every data source

- Every file type

- Every content

- Every classification

- Every analysis and application

- Complete authorisation concepts

- Analysable documentation

Talk to our data experts

Arrange a consultation